kiselnya.ru

Categories

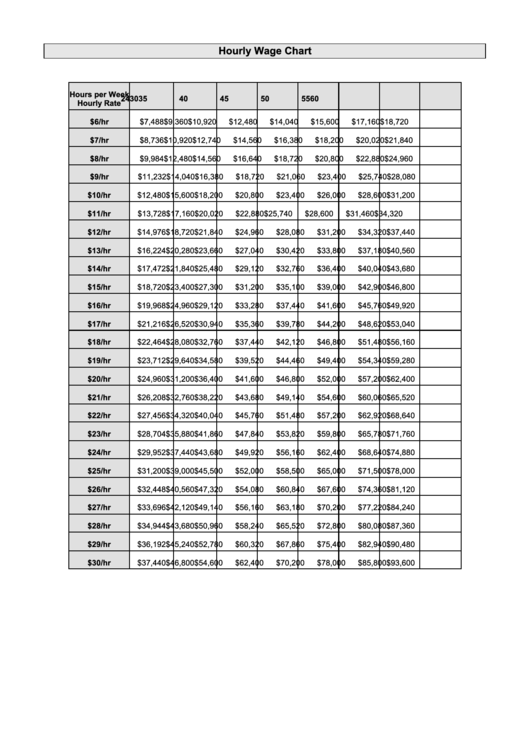

15 Hourly To Salary

For those earning $15 an hour and working 40 hours a week, the annual salary comes out to approximately $31, Crunching Numbers: What $15 an Hour Looks Like. Maryland (As of January 1, ). Under the Fair Wage Act, all employers (regardless of size) pay $15 per hour wages plus tips for tip credit hours. $15 per hour is how much per year? If you earn $15 per hour and work 52 weeks per year, your annual salary equates to $31, This is based upon a standard. If you make $20 an hour and work hours per week, your annual salary is $20 x x 52, or $39, Calculating an Hourly Wage from an Annual Salary. If. Multiply that variety by fifty two (the variety of weeks in 12 months). This gives the exact amount you earn yearly. Assuming you earn $25 an hour and work Salary Calculator – Convert Hourly to Annual Income. This salary calculator can be used to estimate your annual salary equivalent based on the wage or rate. Earning $15 per hour results in a weekly income of $ Assuming you work a full-time job, which typically involves 40 hours per week. The average PART TIME $15HR SALARY in the United States as of July is $ an hour or $ per year. Get paid what you're worth! If you make $ per hour, your Yearly salary would be $31, This result is obtained by multiplying your base salary by the amount of hours, week, and. For those earning $15 an hour and working 40 hours a week, the annual salary comes out to approximately $31, Crunching Numbers: What $15 an Hour Looks Like. Maryland (As of January 1, ). Under the Fair Wage Act, all employers (regardless of size) pay $15 per hour wages plus tips for tip credit hours. $15 per hour is how much per year? If you earn $15 per hour and work 52 weeks per year, your annual salary equates to $31, This is based upon a standard. If you make $20 an hour and work hours per week, your annual salary is $20 x x 52, or $39, Calculating an Hourly Wage from an Annual Salary. If. Multiply that variety by fifty two (the variety of weeks in 12 months). This gives the exact amount you earn yearly. Assuming you earn $25 an hour and work Salary Calculator – Convert Hourly to Annual Income. This salary calculator can be used to estimate your annual salary equivalent based on the wage or rate. Earning $15 per hour results in a weekly income of $ Assuming you work a full-time job, which typically involves 40 hours per week. The average PART TIME $15HR SALARY in the United States as of July is $ an hour or $ per year. Get paid what you're worth! If you make $ per hour, your Yearly salary would be $31, This result is obtained by multiplying your base salary by the amount of hours, week, and.

15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 1 2 3 4 5. Cursor keys can How do I calculate salary to hourly wage? Multiply the hourly wage by the. Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis. annual value to an hourly wage for ease of comparison. The state minimum wage data is sourced from the Labor Law Center and includes the minimum wage in a. Additional information, including the hourly and annual 10th, 25th, 75th Computer and Mathematical Occupations; Architecture and. Easily convert an employee's compensation from hourly to salary, or vice versa. HR Pros rely on Namely's software platform for payroll and compliance. The following table shows what an hourly wage earner would make per week for 20, 30 & 40 hour work weeks. Please note, these numbers are exclusive of income tax. If you make $20 an hour and work hours per week, your annual salary is $20 x x 52, or $39, Calculating an Hourly Wage from an Annual Salary. If. Hourly: $ Weekly: $ Monthly: $2, Annual: $31, Wage Conversion Calculations. Weekly wage = hourly wage times hours per week. Annual. Here is a list of City and County minimum wages in California maintained by UC Berkeley. After the state minimum wage reached $15 an hour, the rate is. Calculate hourly and premium rates that could apply if you are paid overtime. If you are paid on an hourly or daily basis, the annual salary calculation does. If you make $15 per hour and are paid for working 40 hours per week for 52 weeks per year, your annual salary (pre-tax) will be 15 × 40 × 52 = $31, If you make $ an hour, your yearly salary would be $32, Assuming that you work 40 hours per week, we calculated this number by taking into. Hourly Wage to Weekly, Bi-Weekly, Monthly & Annual Salary Table ; $15, $, $1, ; $20, $, $1, ; $25, $1,, $2, ; $30, $1,, $2, SmartAsset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Enter your info to see your take home pay. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Using 10 holidays and 15 paid vacation days a year, subtract. be Total Weekly Pay = Regular Weekly Pay + Overtime Weekly Pay salary, weekly salary and consequently into hourly wages by the following formula. Maryland (As of January 1, ). Under the Fair Wage Act, all employers (regardless of size) pay $15 per hour wages plus tips for tip credit hours. Here is a list of City and County minimum wages in California maintained by UC Berkeley. After the state minimum wage reached $15 an hour, the rate is. Use this calculator to determine your equivalent annual salary when given what you get paid per hour - it may surprise you what you make on a yearly basis. An hourly wage of $15 is equivalent to $29, a year under the assumption of 49 full hour working weeks in a year. In terms of a monthly salary this is.

How To Check If A Restraining Order Is Still Active

restraining order as a “Protected Person. The result of the Permanent Protection Order hearing will determine if the Temporary Protection Order becomes. What to Expect When Filing or Responding to a Petition for an Order of Protection from Domestic Violence or Stalking. Circuit Court Judge Susan Carbon provides. There are a few ways to find out. The easiest would be to pay a background investigation company to run him nationally. It will cost you about. if they are current and still valid. Comparable protection orders issued in Check with the Domestic Violence Unit if you are not sure. One solution. And the order can last up to 3 years. If you want to tell your side of the story, file and serve the Response (DV) BEFORE your court date. Even if you do. of this so the appropriate request can be made when the case is called in court. A Criminal Protective Order is contingent upon criminal proceedings and/or. The Orders of Protection Dashboard shows counts of orders issued (not individuals) from to the previous calendar year. If your papers have a court date, go to that court date. This is your only chance to tell a judge you disagree with the restraining order. If the papers don't. IMPORTANT: If you are in danger now and need help, call or text "" Warning: People can tell what internet sites you've visited on your computer. Be safe! restraining order as a “Protected Person. The result of the Permanent Protection Order hearing will determine if the Temporary Protection Order becomes. What to Expect When Filing or Responding to a Petition for an Order of Protection from Domestic Violence or Stalking. Circuit Court Judge Susan Carbon provides. There are a few ways to find out. The easiest would be to pay a background investigation company to run him nationally. It will cost you about. if they are current and still valid. Comparable protection orders issued in Check with the Domestic Violence Unit if you are not sure. One solution. And the order can last up to 3 years. If you want to tell your side of the story, file and serve the Response (DV) BEFORE your court date. Even if you do. of this so the appropriate request can be made when the case is called in court. A Criminal Protective Order is contingent upon criminal proceedings and/or. The Orders of Protection Dashboard shows counts of orders issued (not individuals) from to the previous calendar year. If your papers have a court date, go to that court date. This is your only chance to tell a judge you disagree with the restraining order. If the papers don't. IMPORTANT: If you are in danger now and need help, call or text "" Warning: People can tell what internet sites you've visited on your computer. Be safe!

In most counties, civil and criminal courts are separate, so there may be two court dates related to the same incident: one to determine if the defendant is. If the respondent has not been served with a copy of the temporary protective order before the hearing, the petitioner can still attend the hearing and request. It's a court order that says one person must refrain from doing certain acts against another person. It's Maryland's version of a restraining order or stay-. Petitioners may register to receive automated telephone or email notifications when a Temporary Restraining Order (TRO) has been served by law enforcement. This form tells you if the judge made temporary orders against you. Look through it carefully and follow all the orders. Tell the judge and the District Attorney if you have another restraining order. Do not interrupt, even if someone in court says something bad about you. still be eligible for a civil protective order. If that is your situation The protective or no contact order will tell you how long the order is in effect. If a temporary protective order is issued, you will receive a certified copy. The sheriff's department will serve the order to the respondent. The Superior. (if there is an active investigation), the guardian At the return hearing, the court will decide whether to issue a temporary restraining order to stay in. Tell the clerk or the magistrate that you want to file for a domestic violence protective order.. If you need the emergency protection of an ex parte temporary. Allows law enforcement agencies to verify the existence of a valid order and service information immediately. Allows petitioners to be notified when the order. If filing a criminal report in addition to a restraining order, go to the municipal court or police department where the domestic violence occurred. Domestic. If one is issued, the application is then updated to an ex parte restraining order. The Judge can also deny the ex parte relief and issue an Order for Hearing. If the Judge grants your petition for an Order of Protection the court will immediately send the Order of Protection and a copy of the petition for service on. If a restraining order is issued, a court will order a restrained party to if that person still feels threatened at the expiration of the order. still request a hearing where you and the respondent will appear before the judge. If your petition is approved, a permanent injunction may be ordered. The statewide registry also provides limited public access to protective orders when the protected person has authorized access. Please enter either the case number or a partial last name of the restrained person to search. Note: If the case number is in the format. If there is good cause, the judge will issue a temporary order of protection. There will be a future court date to determine if the order of protection will. Unlike a restraining order, an order of protection carries criminal penalties for violation. An order of protection is valid in every state and should be upheld.

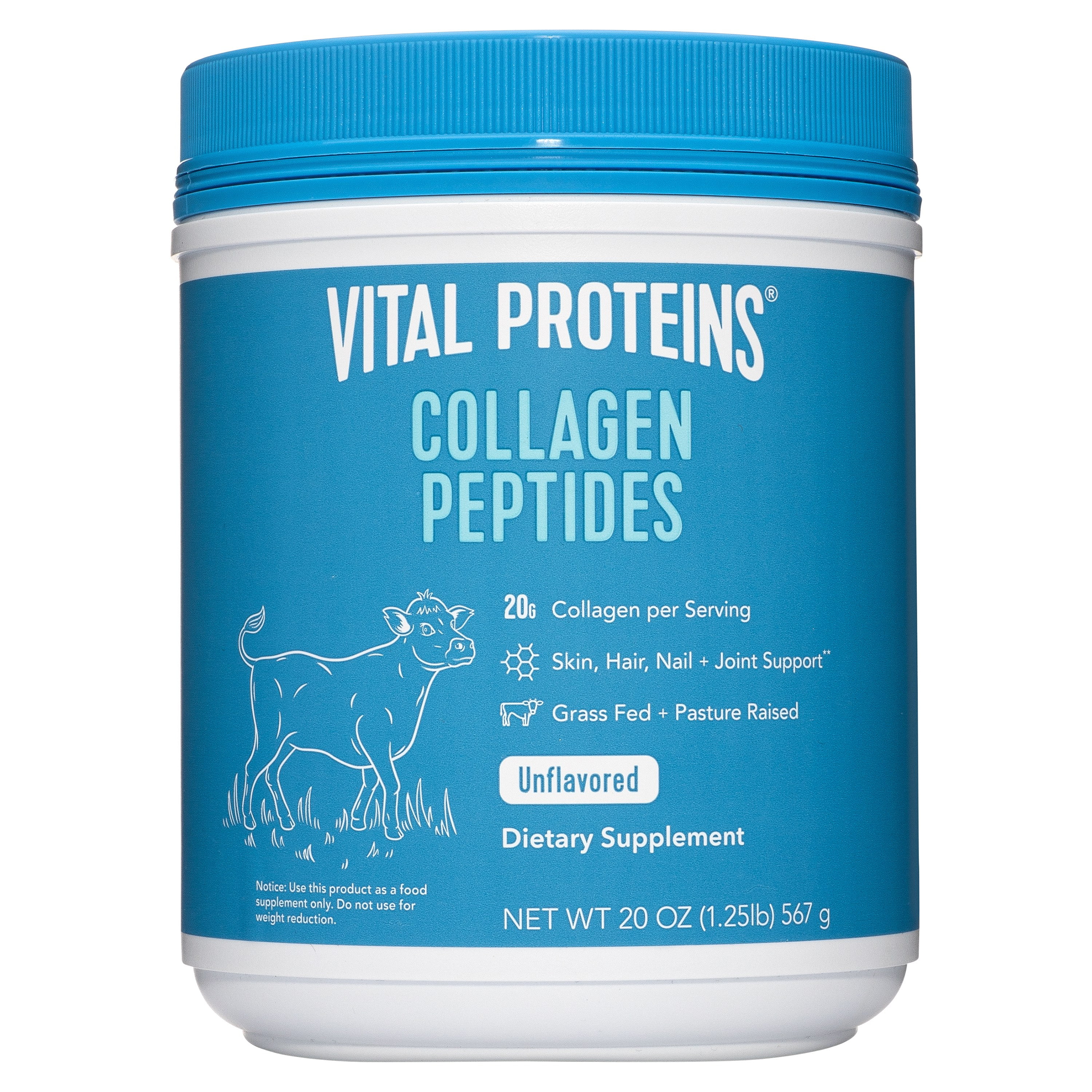

What Type Of Collagen Is Vital Proteins

Vital Proteins Collagen Peptides, Unflavored, lbs 20g Collagen Peptides Skin, Hair & Nail Support Supports Healthy Joints & Bones Made without Gluten. What Types Of Collagen Are In Our Collagen Peptides? Our celebrity-loved collagen powder is Types I and III. Type I is the most prevalent type of collagen. Type III Collagen Type III collagen is also found in Vital Proteins' line of collagen products. The third commonly found type of collagen, Type III, is. This animal variety collagen supports overall wellness while delivering a significant dose of protein. Calories 70, Protein 18 gram, Sodium milligram. Type III Collagen Type III collagen is also found in Vital Proteins' line of collagen products. The third commonly found type of collagen, Type III, is. Vital proteins, collagen peptides, and marine collagen are rich in types I and III collagen. What are collagen peptides? Collagen peptides are soluble. What Types Of Collagen Are In Our Marine Collagen Powder? Our pescatarian-friendly marine collagen powder is Types I and III. Type I is the most prevalent. Vital Proteins Collagen Peptides Powder, Unflavored 24 oz. ; In cold & hot no clumps! · Verified Purchaser ; Sort by. Most Recent ; Arthritis · Verified Purchaser. Vital Proteins® Marine Collagen is sustainably sourced from the scales of non-GMO, wild-caught white fish off the coast of Alaska. It's as easy as scoop, stir &. Vital Proteins Collagen Peptides, Unflavored, lbs 20g Collagen Peptides Skin, Hair & Nail Support Supports Healthy Joints & Bones Made without Gluten. What Types Of Collagen Are In Our Collagen Peptides? Our celebrity-loved collagen powder is Types I and III. Type I is the most prevalent type of collagen. Type III Collagen Type III collagen is also found in Vital Proteins' line of collagen products. The third commonly found type of collagen, Type III, is. This animal variety collagen supports overall wellness while delivering a significant dose of protein. Calories 70, Protein 18 gram, Sodium milligram. Type III Collagen Type III collagen is also found in Vital Proteins' line of collagen products. The third commonly found type of collagen, Type III, is. Vital proteins, collagen peptides, and marine collagen are rich in types I and III collagen. What are collagen peptides? Collagen peptides are soluble. What Types Of Collagen Are In Our Marine Collagen Powder? Our pescatarian-friendly marine collagen powder is Types I and III. Type I is the most prevalent. Vital Proteins Collagen Peptides Powder, Unflavored 24 oz. ; In cold & hot no clumps! · Verified Purchaser ; Sort by. Most Recent ; Arthritis · Verified Purchaser. Vital Proteins® Marine Collagen is sustainably sourced from the scales of non-GMO, wild-caught white fish off the coast of Alaska. It's as easy as scoop, stir &.

Discover Vital Proteins collagen peptides for hair, nails, skin, and overall wellness. Browse Vital Proteins gummies, powders, and more at The Vitamin. Vital Proteins Collagen Peptides® is made without dairy or gluten and is both paleo and keto friendly. Vital Proteins Collagen Peptides Powder Supplement (Type I, III) Travel Packs, Hydrolyzed Collagen for Skin Hair Nail Joint - Dairy & Gluten Free - 10g per. +. What Types Of Collagen Are In Our Collagen Peptides? Our celebrity-loved collagen powder is Types I and III. Type I is the most prevalent type of collagen. Our Collagen Peptides contain one single ingredient from upcycled bovine hide. They contain no artificial sweeteners, colors or flavors. Fits your lifestyle. What Types Of Collagen Are In Our Marine Collagen Powder? Our pescatarian-friendly marine collagen powder is Types I and III. Type I is the most prevalent. Vital Proteins is committed to setting the bar when it comes to quality, transparency and clean labels. That's where this best-selling collagen powder comes. This collagen peptides powder is sourced from grass-fed, pasture-raised bovine to ensure a high quality and sustainable source of this powerful ingredient. Collagen is the main structural protein in the extracellular matrix of a body's various connective tissues. As the main component of connective tissue. The Hollywood of collagen powder. With Jennifer Anniston as their Chief Creative Officer, Vital has become the world's largest collagen company. However, their. Vital Proteins Collagen Peptides® is made without dairy or gluten and is both paleo and keto friendly. Vital Proteins' Cartilage Collagen is rich in Type II Collagen Peptides and Glycosaminoglycans, including naturally occurring Chondroitin Sulfate. According to their website, Vital Proteins is not vegan, and they have yet to find a plant-based source of collagen that meets all their standards. The brand. Skin, hair, nail + joint support. Grass fed + pasture raised. Look & Feel Your Best. Made from one simple ingredient. Our collagen peptides are neutral in. Vital Proteins helps people feel better and live fuller lives through sustainably-sourced nutrition products, promoting health, fitness and natural beauty. Looking to add some pep to your wellness routine? Vital Proteins Collagen Peptides helps make that happen with every scoop. Made from one single ingredient. This specific collagen peptide contains Type I and Type II collagen. Please let us know if you have any other questions! Was this helpful? Collagen peptides are an incomplete protein that include a combination of 18 essential and non-essential amino acids, including glycine, hydroxyproline-proline. Boost your health with Vital Proteins Collagen Peptides Supplement Powder. Unflavored, easy to mix! This collagen peptides powder is sourced from grass-fed, pasture-raised bovine to ensure a high quality and sustainable source of this powerful ingredient.

Bond Portfolio Management Strategies

When pursuing a bullet strategy, you purchase several bonds that mature at the same time, minimizing your interest rate risk by staggering your purchase date. How sensitive a portfolio's valuation is to change in interest rates is known as a portfolio's · duration. · Shorter duration bonds help combat the effects rising. A bond portfolio can be managed in several ways; however, the primary methods are active, passive, or a hybrid of the two. Active bond portfolio management. One strategic use of bonds in a portfolio is to increase diversification. · Diversification can be achieved · Spreads indicate the “price” or the yield on default. Passive strategies include buy-and-hold, where bonds are purchased and held to maturity, and indexing, where the portfolio is constructed to match a bond market. Buy and hold involves purchasing individual bonds and holding them to maturity. The premise of this strategy is that bonds are assumed to be safe predictable. Passive Strategies Essentially, passive strategies imply that prices are assumed to reflect fair value. bonds in a bond index (+ for large funds). In contrast to active management, passive bond management strategies usually involve setting up a bond portfolio with specific characteristics that can achieve. There are various bond portfolio strategies and different types of bonds that can be used to maximize returns and minimize risk. When pursuing a bullet strategy, you purchase several bonds that mature at the same time, minimizing your interest rate risk by staggering your purchase date. How sensitive a portfolio's valuation is to change in interest rates is known as a portfolio's · duration. · Shorter duration bonds help combat the effects rising. A bond portfolio can be managed in several ways; however, the primary methods are active, passive, or a hybrid of the two. Active bond portfolio management. One strategic use of bonds in a portfolio is to increase diversification. · Diversification can be achieved · Spreads indicate the “price” or the yield on default. Passive strategies include buy-and-hold, where bonds are purchased and held to maturity, and indexing, where the portfolio is constructed to match a bond market. Buy and hold involves purchasing individual bonds and holding them to maturity. The premise of this strategy is that bonds are assumed to be safe predictable. Passive Strategies Essentially, passive strategies imply that prices are assumed to reflect fair value. bonds in a bond index (+ for large funds). In contrast to active management, passive bond management strategies usually involve setting up a bond portfolio with specific characteristics that can achieve. There are various bond portfolio strategies and different types of bonds that can be used to maximize returns and minimize risk.

In order to effectively employ portfolio strategies that can control interest rate risk and/or enhance returns, you must understand the forces that drive. Enhanced indexing is a core-plus management strategy where the core part of the portfolio is structured to mirror an index or benchmark. The portfolio is. In order to effectively employ portfolio strategies that can control interest rate risk and/or enhance returns, you must understand the forces that drive. Our objective is to help preserve your wealth while providing market-appropriate capital appreciation, liquidity and income. Your portfolio will be designed. Bond portfolio management strategies are based on managing fixed income investments in pursuit of a particular objective – usually maximizing return on. Risky strategy: relying on uncertain kiselnya.ru strategy: staggers maturities. barbell strategy: barbell strategy splits funds between short duration and. We have provided you with a quick introduction the measures of interest rate risk and bond portfolio management strategies used to manage fixed income risk. Cash flow matching is the strategy of funding every component of a liability with a zero-coupon bond. The bond is said to be dedicated to a particular. The belief that excess returns can be achieved by correctly timing changes in yields and/or yield spreads motivates active bond portfolio management strategies. For liability-based fixed-income mandates, portfolio construction follows two main approaches—cash flow matching and duration matching—to match fixed-income. Through in-depth discussions on different types of bonds, valuation principles, and a wide range of strategies, Bond Portfolio Management will prepare you for. One of the major features of active bond portfolio management strategies is that they need to be actively monitored, tracked and analysed. To do this, investors. Answer to: There are 5 primary bond portfolio management strategies: passive; laddering; indexing; immunization; and, active. Select one of these. The simplest possible way to invest in bonds is to buy a diversified bond fund. For example, you can buy the Vanguard Total Bond Market Index Fund (VBMFX). This. Fixed-income portfolio managers can approximate actual and anticipated bond portfolio value changes using portfolio duration and convexity measures. Duration. Active bond management is a popular investment strategy that involves actively managing a bond portfolio in order to enhance returns. The strategy works by diversifying the investment portfolio maturity date-wise to mitigate risk along the interest rate curve. A laddered bond portfolio simply. There are three major types of strategies: 1. passive portfolio management strategies 2. active portfolio management strategies 3. matched-funding strategies. Answer to: There are 5 primary bond portfolio management strategies: passive; laddering; indexing; immunization; and, active. Select one of these.

Share That Give Dividends

Dividends are payments companies make to reward their shareholders for holding on to their stock. They represent a portion of a company's profit. Stocks in the list are ranked by dividend yield. Go to our interactive provide a more personalized web experience. However, you can choose not to. The top dividend-paying stocks for September include several transportation companies — Euronav NV (CMBT), BW LPG Ltd. (BWLP), TORM plc (TRMD), and Hafnia. Dividends are payments companies make to reward their shareholders for holding on to their stock. They represent a portion of a company's profit. Dividends are payments made by companies to their shareholders based on the number of shares they own. Dividends are usually paid when a company has excess cash. 4. Look at dividend growth Generally speaking, you want to find companies that not only pay steady dividends but also increase them at regular intervals—say. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will pay the dividend to the fund, and it will then be passed on to you. The S&P Dividend Aristocrats are an index of 67 companies in the S&P index that have raised their payouts annually for at least 25 consecutive years. Dividends are payments companies make to reward their shareholders for holding on to their stock. They represent a portion of a company's profit. Stocks in the list are ranked by dividend yield. Go to our interactive provide a more personalized web experience. However, you can choose not to. The top dividend-paying stocks for September include several transportation companies — Euronav NV (CMBT), BW LPG Ltd. (BWLP), TORM plc (TRMD), and Hafnia. Dividends are payments companies make to reward their shareholders for holding on to their stock. They represent a portion of a company's profit. Dividends are payments made by companies to their shareholders based on the number of shares they own. Dividends are usually paid when a company has excess cash. 4. Look at dividend growth Generally speaking, you want to find companies that not only pay steady dividends but also increase them at regular intervals—say. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will pay the dividend to the fund, and it will then be passed on to you. The S&P Dividend Aristocrats are an index of 67 companies in the S&P index that have raised their payouts annually for at least 25 consecutive years.

US companies with the highest dividend yields ; PETS · D · %, USD ; MED · D · %, USD ; RILY · D · %, USD ; IEP · D · %, USD. A dividend is an amount of money paid regularly by a company to its shareholders. Dividend stocks are popular among investors because they are typically well-. On the other hand, a dividend payout ratio is the proportion of its net income distributed as dividends as compensation to its shareholders. Generally, dividend. Stocks in the list are ranked by dividend yield. Go to our interactive provide a more personalized web experience. However, you can choose not to. Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy (FANG). Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or. The historical dividend information is provided by Mergent, a third party service, and Notified does not maintain or provide information directly to this. Trends that bode well for dividend-paying stocks include historically high levels of corporate cash, relatively low bond yields, and baby boomers' demand for. Best Dividend Stocks ; AT&T Inc. stock logo. T · AT&T. $ +%, 11, ; Pfizer Inc. stock logo. PFE. Pfizer. $ %, 8, ; Exxon Mobil Co. stock logo. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. For companies that pay dividends, the Dividend Yield can give you an idea how a company's dividend payments relate to its stock price. On the other hand, a dividend payout ratio is the proportion of its net income distributed as dividends as compensation to its shareholders. Generally, dividend. The historical dividend information is provided by Mergent, a third party service, and Notified does not maintain or provide information directly to this. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. Typically, stocks that pay dividends are larger, more established companies. And while these firms have the ability to either continue or increase payouts, they. Dividend Payment Schedule ; 8/9/, 9/10/, $ ; 5/10/, 6/10/, $ ; 2/9/, 3/8/, $ ; 11/10/, 12/8/, $ World's companies with the highest dividend yields ; PPNEPCB · D · MYX, %, MYR ; EEWINT · D · MYX, %, MYR. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. Dividends are distributions of property a corporation may pay you if you own stock in that corporation. Corporations pay most dividends in cash. Investing in high-dividend stocks is a great way to secure funds for retirements and ensure you always have some form of income.

Best Bank For Personal Savings Account

With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance or deposit requirement;. WealthONE ranked #3 in Forbes' Best Online Banks in Canada! 42 Canadian %. WealthONE RRSP Savings Account (Personal Only). %. WealthONE High. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. Star Savings Account. Balance Tier All Balances. Interest Rate %. Annual Percentage Yield (APY) %. Available in all states. Summit Savings Account® for everyday savings. Grow your savings with the best everyday savings account Simplify your banking tasks with our self-serve. Compare Chase savings accounts and select the one that best suits your needs Open a Chase Private Client Savings SM account and get more from your banking. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. Savings accounts that always put your best interest first · Frost · Bank of America · Chase · Wells Fargo. UFB Direct is an online-only bank and a division of the more widely known Axos Bank, headquartered in San Diego. It offers checking, high-yield savings, money. With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance or deposit requirement;. WealthONE ranked #3 in Forbes' Best Online Banks in Canada! 42 Canadian %. WealthONE RRSP Savings Account (Personal Only). %. WealthONE High. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. Star Savings Account. Balance Tier All Balances. Interest Rate %. Annual Percentage Yield (APY) %. Available in all states. Summit Savings Account® for everyday savings. Grow your savings with the best everyday savings account Simplify your banking tasks with our self-serve. Compare Chase savings accounts and select the one that best suits your needs Open a Chase Private Client Savings SM account and get more from your banking. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. Savings accounts that always put your best interest first · Frost · Bank of America · Chase · Wells Fargo. UFB Direct is an online-only bank and a division of the more widely known Axos Bank, headquartered in San Diego. It offers checking, high-yield savings, money.

Savings accounts that always put your best interest first · Frost · Bank of America · Chase · Wells Fargo. Best high-yield savings account rates of August ; Capital One. Performance Savings · % ; American Express National Bank (Member FDIC). High Yield. Neo's two main savings accounts are the Neo High-Interest Savings account which earns % interest, and the Neo Money account, which earns % interest and. Open your RBC Bank U.S. checking and savings account today We'll suggest the best bank account and credit card based on your needs. Compare today's best high-yield savings account rates with our ranking of over national banks and credit unions. Today's top APY is % from Poppy. We believe a fundamental aspect of modern banking is ease-of-access to your money, and that's why this is a top priority for us. We understand that managing. Whatever you're saving for, we have a personal savings account to get you there. · A basic account with no service charge if a minimum daily balance or average. Banking · Savings accounts. Use a savings account to safely store money that you're not planning to spend but still need quick access to, such as vacation or. savings transfers from a Regions personal checking account. Open now Bank checking account in good standing during the term of the time deposit. Learn more about Huntington's personal Savings accounts, Money Market Accounts, or CDs. Choose from one of our savings accounts and open online today. Top Deposit Links Top Deposit Links. Account Rates · Account Fees All you need to qualify is an eligible Bank of America® personal checking account. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Bank of America Advantage Savings · Bank of America Certificate of Deposit (CD) · Bank of America Individual Retirement Account (IRA). Is there a minimum. Learning good financial habits starts at a young age. Establishing your own bank account will help you build a strong foundation for independence and future. Our top picks for the best high-yield savings account rates are SoFi Bank (%), Bask Bank (%) and Discover Bank (%), but rates are as high as. For example, Bank of America, Chase Bank, and Wells Fargo offer a measly APY of % on their savings accounts, whereas most of the options listed above are. Earn interest with a City National Bank personal savings account. Keep money in a safe place & consult a relationship manager to find the best product for. Grow your savings and achieve your financial goals with high interest. Find the best high interest savings account for you With our Bank the Rest savings. The right personal savings account can help you reach your goals. You can get Zelle, FDIC insurance, overdraft protection and more when you bank with. Move your money between linked Capital One accounts or external bank accounts to take advantage of a high-yield rate. Automatic savings plan. Keep your personal.

What Credit Cards Give You Money For Signing Up

Why we like it: The Blue Cash Preferred is one of the best cash-back credit cards out there. You'll earn 6% cash back at U.S. supermarkets (up to $6, per. offers a $ bonus for making a $ investment. What credit card gives you $ for signing up? There are many cards that offer $ or more for signing up. Cards with the best cash signup bonus? · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June How Does the Extra Card Work? 1. Sign up by connecting your bank account,3 and we give you an independent line of credit (Spend Power) based on your bank. Customize your rewards with the TD Cash Credit Card-and earn a $ Cash Back bonus. Learn more. You can earn cash back on your credit cards by signing up for a cash back card, making purchases to accrue rewards, and redeeming the rewards through your card. Many credit cards offer you a bonus for spending money over a certain period, where rewards points, cash back or airline miles may be offered to get you to. Your Wells Fargo credit card makes it easy and convenient to take control of your money and keep track of spending — with multiple layers of protection to give. Your best bet right now is the Chase Sapphire Preferred Card. I know, it's a travel rewards card and you said you want cash back, but you can. Why we like it: The Blue Cash Preferred is one of the best cash-back credit cards out there. You'll earn 6% cash back at U.S. supermarkets (up to $6, per. offers a $ bonus for making a $ investment. What credit card gives you $ for signing up? There are many cards that offer $ or more for signing up. Cards with the best cash signup bonus? · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June How Does the Extra Card Work? 1. Sign up by connecting your bank account,3 and we give you an independent line of credit (Spend Power) based on your bank. Customize your rewards with the TD Cash Credit Card-and earn a $ Cash Back bonus. Learn more. You can earn cash back on your credit cards by signing up for a cash back card, making purchases to accrue rewards, and redeeming the rewards through your card. Many credit cards offer you a bonus for spending money over a certain period, where rewards points, cash back or airline miles may be offered to get you to. Your Wells Fargo credit card makes it easy and convenient to take control of your money and keep track of spending — with multiple layers of protection to give. Your best bet right now is the Chase Sapphire Preferred Card. I know, it's a travel rewards card and you said you want cash back, but you can.

Security deposit required up to the approved credit limit. Loyalty Cash Bonus. when you redeem your rewards into a Truist deposit account. Visa® Platinum Card. Save on interest with a great low introductory rate for an extended time. ; Visa® Max Cash Preferred Card. Earn more on the categories you. 0% intro APR for 15 months on purchases and balance transfers after your account opening. · Earn unlimited 1% cash back on every purchase · No annual fee · No. Earn unlimited % cash back on every purchase, every day. Plus a $ cash bonus. See new cardmember offer details below. Blue Cash Preferred Card from American Express · Delta SkyMiles Platinum American Express Card · Delta SkyMiles Gold American Express Card · Marriott Bonvoy. The best credit cards offer a range of incentives, including travel rewards, cash back, sign-up bonuses, and more. Learn more about credit card offers. Apply for a new PNC Cash Rewards Visa credit card through kiselnya.ru Offer available when applying through any of the links provided on this page. If approved. Many credit cards offer a welcome bonus, which means new cardholders earn extra rewards, such as cash back, points or miles, when they use their card. NEW $84 Dunkin' Credit. Earn up to $7 in monthly statement credits after you pay with the American Express® Gold Card at Dunkin' locations. Enrollment required. Earn $ cash back after you spend $1, on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20, ThankYou® Points. To earn an intro bonus, you'll first need to be approved for a credit card that offers sign-up bonuses to new cardholders. Then, you'll typically need to. The Chase Sapphire Preferred® Card offers a sign-up bonus: Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account. The US Bank Triple Cash Rewards Visa Business Card gives back on all your eligible business needs with no annual fee. 3% cash back in the category of your choice · $ online cash rewards bonus offer · Low Introductory APR Offer · No annual fee · Get even more rewards. You can earn cash back on your credit cards by signing up for a cash back card, making purchases to accrue rewards, and redeeming the rewards through your card. Rewards cards typically offer benefits such as points, miles or cash back. You have to earn the sign-up bonus. When signing up for a rewards credit card. Intro Offer: Earn an additional % cash back on everything you buy (on up to $20, spent in the first year) - worth up to $ cash back! Finance your purchases with one of our flexible credit products. Or use money from your PayPal Balance account with the PayPal Debit Card. Get the AppSign Up. Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly. 3% cash back in the category of your choice · $ online cash rewards bonus offer · Low Introductory APR Offer · No annual fee · Get even more rewards.

Small Business Credit Card Processing Comparison

-jpg.jpeg)

Best credit card processors. Stripe: Best for optimizing business operations. Square: Great for connecting with customers. Clover: Excellent industry-specific. A critical difference between EMS and the other companies such as, Helcim, Square, Stax Payments, PaymentCloud, PayPal, National Processing, and Stripe is time. There are a lot of options for small business credit card processing. This guide will show you what to look for and how to keep costs down. Merchant One has been in business for 20 years, we use state-of-the-art point of sale systems, and offer credit card payment processing solutions. Compare Business Credit Cards ; APR on cash advances%. Varies with the market based on Prime Rate. ; APR on cash advances%. List of credit card processing providers · Clover: Clover is an excellent processor for businesses just getting started accepting credit card payments. · Merchant. We evaluated processing fees, contract terms, transparent billing practices, and more to find the cheapest credit card processors. List of credit card processing providers · Clover: Clover is an excellent processor for businesses just getting started accepting credit card payments. · Merchant. Affordable credit card processing for your business. Helcim saves you 25% on in-person and online credit card payments with no hidden fees, no monthly fees. Best credit card processors. Stripe: Best for optimizing business operations. Square: Great for connecting with customers. Clover: Excellent industry-specific. A critical difference between EMS and the other companies such as, Helcim, Square, Stax Payments, PaymentCloud, PayPal, National Processing, and Stripe is time. There are a lot of options for small business credit card processing. This guide will show you what to look for and how to keep costs down. Merchant One has been in business for 20 years, we use state-of-the-art point of sale systems, and offer credit card payment processing solutions. Compare Business Credit Cards ; APR on cash advances%. Varies with the market based on Prime Rate. ; APR on cash advances%. List of credit card processing providers · Clover: Clover is an excellent processor for businesses just getting started accepting credit card payments. · Merchant. We evaluated processing fees, contract terms, transparent billing practices, and more to find the cheapest credit card processors. List of credit card processing providers · Clover: Clover is an excellent processor for businesses just getting started accepting credit card payments. · Merchant. Affordable credit card processing for your business. Helcim saves you 25% on in-person and online credit card payments with no hidden fees, no monthly fees.

Comparing Bankrate's top small-business credit cards. Business Credit Card machine. Every card does its job by covering something different. GoCardless is a great payment processor for small businesses with its user-friendly dashboard and streamlined integration. Rather than focusing on card payments. FIS eZ Business. Give your corporate and small business card customers the ability to manage the commercial cards their employees use while streamlining your. Merchant One has been in business for 20 years, we use state-of-the-art point of sale systems, and offer credit card payment processing solutions. The Best Credit Card Processing For Small Business · Stax: Best Overall · National Processing: Best For Flat-Rate Pricing · Helcim: Best For International. card payments.**. QuickBooks Online. Paid accounting plans that include access to online payments, banking, and connected business tools. Starting at %*. Credit Card Machines for Small Business ; Clover Flex Special. $ ; Clover Go. $ ; Clover Flex. $ ; Clover Flex Bundle. $ ; Star Micronics mPOP. Qualified transactions are given a very low, favorable rate (which often attracts businesses), but higher credit card processing rates on non-qualified and mid-. Match your unique business with the right payment processor. Does your business sell services or products? Online, in person, or both? Do you want a credit card. In general, Stripe is the best credit card processor for new online stores because it's % free with zero monthly fees. But after a certain threshold, both. This pricing model is a good choice if your customers prefer paying with debit cards. This is the pricing model most experts recommend for small businesses. Credit card processing rates are typically expressed as a percentage of the sale plus a small per-transaction fee. Most rates average 2% to 4% of each. Realistically, you have almost no control over your effective rate and neither does your processor. The only thing that can be controlled is the. Check funding options, Card Processing Fees and Business Insurance in minutes to see if you are on the right deal for your business. In , it is simply not possible to do business without accepting credit card payments. According to a recent survey, around 70% of consumers prefer credit or. Credit card processing is essential for small businesses today. In addition to being more convenient than cash and checks, card payments offer many other. Best cheap credit card processing companies. Square: Best credit card processing company. ProMerchant: Best for personalized customer service. Paysafe: Best for. Some small business-friendly payment processors include Payment Depot, Stripe, Square, Clover, and Stax. These processors offer a range of features and. Comparing Bankrate's top small-business credit cards. Business Credit Card machine. Every card does its job by covering something different. Compare small business credit cards side by side with this convenient small business credit card comparison tool. See the benefits and fees for each and.

Bond Risk Premium

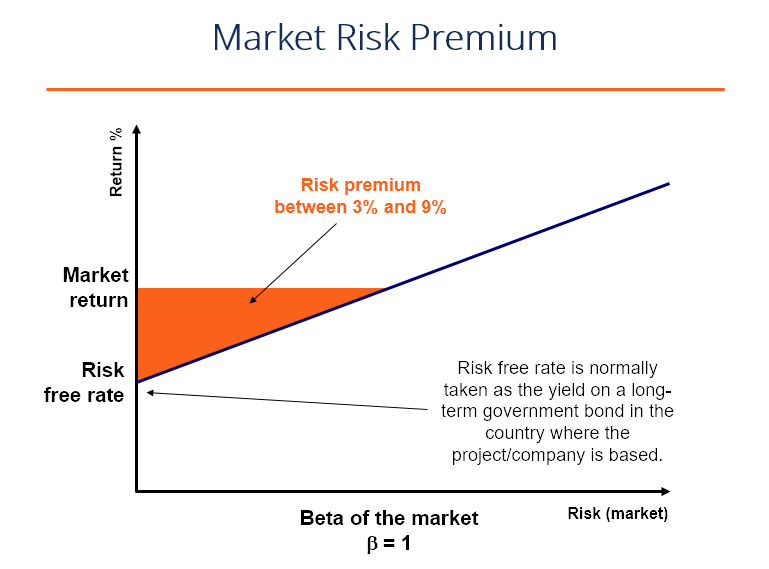

The concept of a country risk premium refers to an increment in interest rates that would have to be paid for loans and investment projects in a particular. Carry-Bond. 0. 3. Carry theoretical terms, if the risk premium is “pure” then it should. Risk premium is calculated by subtracting the risk-free rate from the estimated rate of return. The risk-free rate is usually the interest rate on short-term. Country Risk Premium (CRP) is the add on return asked by an investor to compensate them for the additional risk that when thinking of investing in a foreign. Equity risk premium is calculated as the difference between the estimated real return on stocks and the estimated real return on safe bonds. A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. We study time variation in expected excess bond returns. We run regressions of one-year excess returns on initial forward rates. In depth view into US Corporate BBB Bond Risk Premium including historical data from to , charts and stats. The Equity Risk Premium and its Impact on Bond Attractiveness The equity risk premium is the extra return investors should get from stocks. The concept of a country risk premium refers to an increment in interest rates that would have to be paid for loans and investment projects in a particular. Carry-Bond. 0. 3. Carry theoretical terms, if the risk premium is “pure” then it should. Risk premium is calculated by subtracting the risk-free rate from the estimated rate of return. The risk-free rate is usually the interest rate on short-term. Country Risk Premium (CRP) is the add on return asked by an investor to compensate them for the additional risk that when thinking of investing in a foreign. Equity risk premium is calculated as the difference between the estimated real return on stocks and the estimated real return on safe bonds. A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. We study time variation in expected excess bond returns. We run regressions of one-year excess returns on initial forward rates. In depth view into US Corporate BBB Bond Risk Premium including historical data from to , charts and stats. The Equity Risk Premium and its Impact on Bond Attractiveness The equity risk premium is the extra return investors should get from stocks.

To calculate a country's risk premium, the interest rate offered by the country on purchases of its government debt (generally the year bond) is subtracted. A risk premium is the extra return above the risk-less rate that must be offered by a security that pays well in good states of the world. A risk premium is the investment return an asset is expected to yield in excess of the risk-free rate of return. Risk premium is calculated by subtracting the risk-free rate from the estimated rate of return. The risk-free rate is usually the interest rate on short-term. Some risky securities will provide a risk premium. However, the premium will be associated with the risk of doing badly when times are bad. Some risky securities will provide a risk premium. However, the premium will be associated with the risk of doing badly when times are bad. However, there is 'reinvestment rate' risk if the expected return is used for a long term investment analysis. (b) Long term Government Bond Rate: because it. The risk-free rate of return is usually represented by government bonds, usually in the form of US treasury bills – which can sometimes also act as a proxy for. The market risk premium is the rate of return on a risky investment. The difference between expected return and the risk-free rate will give you the market risk. Rising interest rates and elevated stock multiples, driven primarily by multiple expansion, have brought down the equity risk premium (ERP), leaving bonds more. A default risk premium is effectively the difference between a debt instrument's interest rate and the risk-free rate. Without scaling by the Expected Loss Rate, the Credit Risk Premium is less than 10 basis points of bond principal for Aaa rated bonds, and more than basis. Consistent with the empirical observation, risk premiums of long-term Treasury bonds remain positive under the F regime in the model while the stock-bond. Some studies show that the average equity risk premium tends to be slightly more than 4% in the long term – in other words, equities historically outperform. Defined as the excess return that an investor expects to earn on a stock when compared to a risk-free asset such as a government bond, equity risk premium. The bond yield plus risk premium (BYPRP) approach is another method we can use to determine the value of an asset, specifically, a company's publicly traded. That is similar to the Moody's Baa inflation-adjusted bond yield of percent (over the past 25 years). A liquidity premium of 1 to 2 percent is needed to. Equity risk premium is the amount by which the total return of a stock market index exceeds that of government bonds. Maturity risk premium – Maturity relates to the date that the bond must be repaid. · Inflation risk premium · Liquidity risk premium · Default risk premium. A bond risk premium is the rate of return on investing a debt instrument which is riskier than the risk-free bond. On the other hand, the equity risk premium is.

How Do I Add Money To My Chime Account

To continue to get money in your Chime account, set up direct deposit from your employer or payroll provider. You can also deposit cash fee-free at any of the. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. After going into the store, go to the MoneyCenter counter or the customer service desk and ask the cashier to load the amount onto your Chime card. Step 2: Link Cash App to Chime Account · Open the Cash App and tap on the “Banking” tab. · Select “Add a Bank” and deposit speed, and search for “Chime” in the. Can I Send and Receive Money With Chime? · Launch the Chime mobile app and log in. · Go to the Pay Anyone tab. · Find the recipient by entering their $ChimeSign or. Log in to your Chime mobile app. · Select the Pay Anyone tab. · Enter the email or phone number of someone who isn't on Chime. · Enter the amount to send to the. Go to the cashier, tell them how much you want to deposit, swipe your card on the card reader, money is deposited instantly. To move money from Chime to Cash App, add your Chime debit card to Cash App. · You can also link your Chime bank account to Cash App to spend your funds with. Transfer money from an external account · Click Move Money. · Select Transfer from other banks. · When prompted, enter the login credentials for your other bank or. To continue to get money in your Chime account, set up direct deposit from your employer or payroll provider. You can also deposit cash fee-free at any of the. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. After going into the store, go to the MoneyCenter counter or the customer service desk and ask the cashier to load the amount onto your Chime card. Step 2: Link Cash App to Chime Account · Open the Cash App and tap on the “Banking” tab. · Select “Add a Bank” and deposit speed, and search for “Chime” in the. Can I Send and Receive Money With Chime? · Launch the Chime mobile app and log in. · Go to the Pay Anyone tab. · Find the recipient by entering their $ChimeSign or. Log in to your Chime mobile app. · Select the Pay Anyone tab. · Enter the email or phone number of someone who isn't on Chime. · Enter the amount to send to the. Go to the cashier, tell them how much you want to deposit, swipe your card on the card reader, money is deposited instantly. To move money from Chime to Cash App, add your Chime debit card to Cash App. · You can also link your Chime bank account to Cash App to spend your funds with. Transfer money from an external account · Click Move Money. · Select Transfer from other banks. · When prompted, enter the login credentials for your other bank or.

Choose whether to pay with your credit3/debit card or with your bank account. Confirm, send and track your transfer. Now your money. Instant transfers: Instantly send funds to your linked bank account using your debit card 24 hours a day, 7 days a week, for a % fee per transfer. Same. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. Open a new Chime account through a referral link provided by a relative or friend, then receive a qualifying direct deposit of $ or more within the first Best Ways to Send Money to a Chime Account · 1. Transfer from Another Bank Account · 2. Pay Anyone with Chime · 3. Deposit Cash · 4. Using Third-. You have immediate access to all of your savings if something comes up, you can quickly transfer money from your savings account right to your Spending account. Where can I deposit cash into my Chime Checking Account? · Walmart · 7-Eleven · Speedway · Dollar General · Family Dollar · CVS · Rite Aid · Pilot Travel Centers (Pilot. it will not let me link my chime checking account to ebay and it will not let me cash out via paypal Well you can get direct deposit on chime so if you can. ¹Chime Checking Account and $ qualifying direct deposit required to apply for the secured Chime Credit Builder Visa® Credit Card. my account's stability or. Deposit cash · Transfer funds from your other Chime accounts · Use the Move My Pay feature in the Chime app: Go to Settings. Select Account settings. Tap Move My. Can Someone Send Me Money To My Chime Account? Yes, anyone can send money to your Chime account. There are multiple ways to do this, which are. Choose “Pay” to make payment. The money will automatically be moved from your Chime account as your accounts are linked. Note: This is a great option if you are. Transfer money out of the Google Wallet website You can transfer money from Google Pay to a bank account. Go to kiselnya.ru ¹Chime Checking Account and $ qualifying direct deposit required to apply for the secured Chime Credit Builder Visa® Credit Card. my account's stability or. How to update your bank account information · Go to your card info: On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button the more button. Choose whether to pay with your credit3/debit card or with your bank account. Confirm, send and track your transfer. Now your money. How do I transfer funds between my accounts onlineFootnote 1?Expand. To Choose the account you want to transfer money from, the account you want. it will not let me link my chime checking account to ebay and it will not let me cash out via paypal Well you can get direct deposit on chime so if you can. Once the transfer arrives, you'll be able to withdraw money from an ATM via your other debit card using cash initially from your Chime account. However, this.

1 2 3 4 5